April Dunn

Mortgage Broker/OwnerThe RED DOOR Mortgage Group – Mortgage Architects

Changing Lives: One Mortgage At A Time

Latest Blog Posts

New Minimum Down Payment Calculator

On February 15 2016, mortgages insured by CMHC will have new down payment rules. See if your new mortgage will be effected by these changes. What's the price? We'll show you if the new down payment rules effect you. Calculate now. This calculator is designed to help...

Insured Mortgage Changes

There have been many changes to insured mortgages in the last few years. Some are finding it more challenging to qualify particularly if you are self-employed or are looking to purchase an investment property. Amortizations have been reduced, premiums have increased...

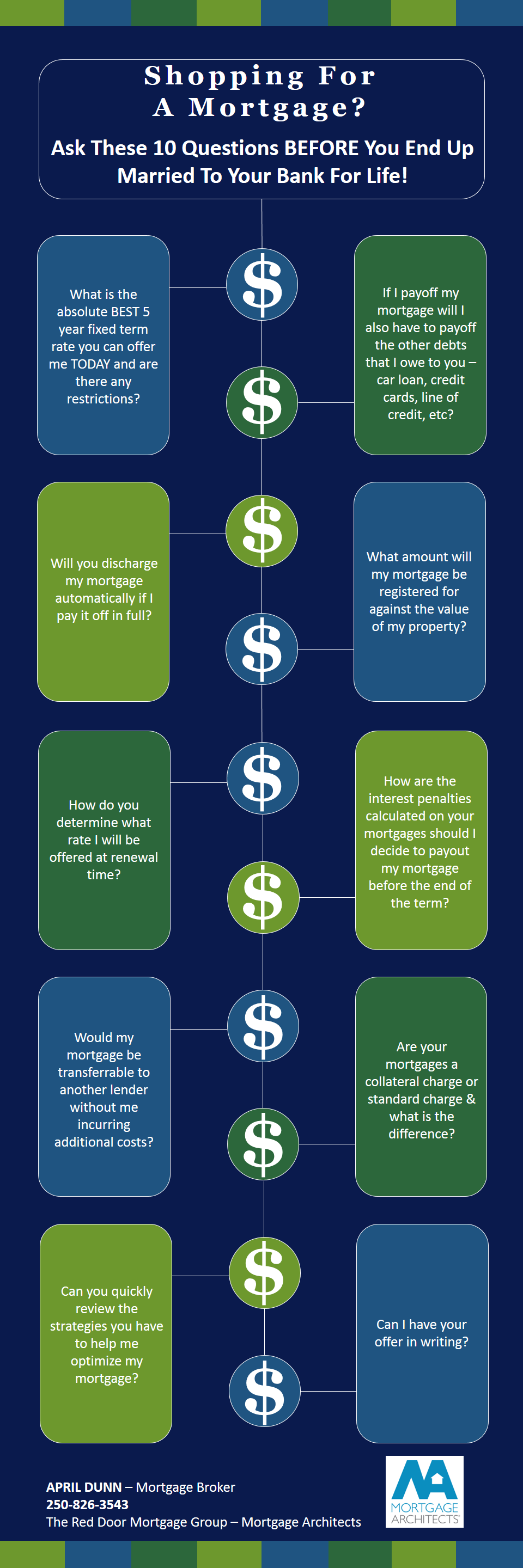

10 Questions To Ask Your Bank

Shopping for a mortgage? Here are 10 questions to ask your bank before you end up married to them for life. Your home is most likely your largest financial asset so make sure you aren't just considering the interest rate that is being offered on your mortgage. There...

Meeting The Subject To Financing Date

Here's an Infographic that I created to explain what might cause delays in meeting your client's Subject to Financing date. Working together, Mortgage brokers and REALTORS® can ensure that the process goes smoothly for our mutual clients. Please feel free to...

What’s The Difference?

So what's the difference in pre-payment penalties? Assisting you to understand that there is much more to a mortgage than the interest rate is one of the most important responsibilities I have to my clients. Even with the best laid plans the unexpected can happen so...

Credit Repair Action List

As a mortgage broker, it is my business to assist you in getting the best possible rate for your current situation. Unfortunately your credit rating can affect your ability to get the best mortgage rates. If you have large credit card balances, too many accounts or...

Start Your Mortgage Process From The Comfort Of Your Own Home

Just Getting Started?

Exciting times! Let’s find out how much you’ll be able to afford once you decide to buy.

I Have A Specific Home In Mind

Great! Let’s find out whether you’ll be able to afford to buy it!

I Want To Refinance My Home

No problem! Let’s find out how much you could take out.